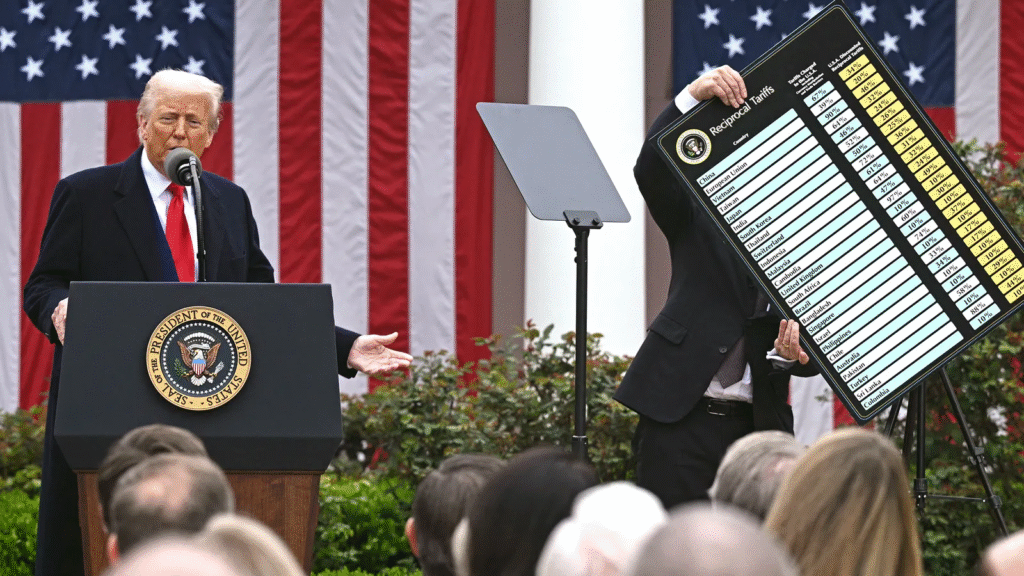

Washington.- Donald Trump began imposing higher import taxes on dozens of countries on Thursday, just as the economic repercussions of months of tariff threats have begun to cause visible damage to the economy of the United States.

Just after midnight, goods from more than 60 countries and the European Union faced tariffs of 10% or more. Products from the EU, Japan, and South Korea are taxed at 15%, while imports from Taiwan, Vietnam, and Bangladesh are subject to a 20% tariff. Trump also expects places such as the EU, Japan, and South Korea to invest hundreds of billions of dollars in the US.

«I think the growth is going to be unprecedented,» Trump said Wednesday afternoon. He also said that the United States was «receiving hundreds of billions of dollars in tariffs,» but was unable to provide an exact revenue figure because «we don’t even know what the final number is» regarding tariff rates.

Despite the uncertainty, the Trump White House is confident that the implementation of its broad tariffs will bring clarity to the direction of the world’s largest economy. Now that companies understand the direction the country is taking, the Republican administration believes it can attract new investment and revive hiring in a way that will rebalance the economy as a manufacturing powerhouse.

But for now, there are signs that the US is shooting itself in the foot, as both businesses and consumers brace for the impact of the new tariffs. What the data shows is that the US economy changed in April with the initial implementation of Trump’s tariffs, a measure that caused a crisis in the markets, a period of negotiation, and the president’s final decision to apply universal tariffs starting Thursday.

Many economists say that the risk is that the US economy will gradually erode rather than collapse suddenly due to the impact of tariffs. Photo: iStock

Risk of economic erosion in the US

Economic reports show that hiring began to stagnate, inflationary pressure increased, and housing values in key markets began to decline after April, said John Silvia, managing director of Dynamic Economic Strategy.

«A less productive economy requires fewer workers,» Silvia pointed out in an analysis note. «But there’s more: higher tariffs reduce the real wages of workers. The economy has become less productive, and companies cannot afford to pay the same real wages as before. Actions have consequences.»

Even so, the ultimate impact of the tariffs, which could last for months or even years, remains unknown. Many economists say the risk is that the US economy will gradually erode rather than suddenly collapse.

«We all want it to be like on television, where there’s an explosion, but it’s not like that,» said Brad Jensen, a professor at Georgetown University. «It will be like fine sand in the gears and slow things down.»

Trump has promoted tariffs as a way to reduce Washington’s persistent trade deficit. But importers tried to avoid the tax increase by purchasing more products before the measure took effect. As a result, the $582.7 billion trade imbalance recorded in the first half of the year was 38% higher than in 2024. Total construction spending fell 2.9% in the last year.

The economic impact is not limited to the United States. Germany, which sends 10% of its exports to the US market, saw its industrial production fall by 1.9% in June as Trump’s first rounds of tax hikes took effect. «The new tariffs will clearly weigh on economic growth,» said Carsten Brzeski, global head of macroeconomics at ING Bank.

Confusion in India and Switzerland

The preparations for Thursday fit with the improvised nature of Trump’s tariffs, which have been implemented in various ways, withdrawn, delayed, increased, imposed by letter, and frantically renegotiated. The process has been so confusing that, at the beginning of the week, officials from key trading partners were unclear whether the tariffs would take effect on Thursday or Friday. The text of the July 31 order to delay their implementation from August 1 stated that the new tax rates would begin in seven days.

Trump announced on Wednesday additional tariffs of 25% on India for purchasing Russian oil, bringing its total tariffs to 50%.

A major group of Indian exporters said on Thursday that the latest US tariffs will affect nearly 55% of the country’s shipments to America and force exporters to lose their long-standing customers.

«Absorber ese repentino aumento de costos simplemente es inviable. Los márgenes ya son escasos», afirmó S.C. Ralhan, presidente de la Federación de Organizaciones de Exportación de India, en un comunicado.

Se espera que el poder ejecutivo suizo, el Consejo Federal, celebre una reunión extraordinaria el jueves después de que la presidenta, Karin Keller-Sutter, y otros altos funcionarios del país regresaron de un viaje de última hora a Washington en un intento fallido de evitar aranceles del 39%.

Tariffs still apply to pharmaceutical drugs, and Trump announced 100% tariffs on computer chips. That could leave the US economy in limbo as it waits for the impact.

Guerra comercial de Trump. FotoArte El Universal

Stock market remains steady

The president’s use of a 1977 law to declare an economic emergency allowing him to impose tariffs is also being questioned. The imminent ruling of a hearing held last week in a US appeals court could force the Republican to seek other legal justifications if the judges consider that he exceeded his authority.

Even people who worked with Trump during his first term are skeptical about the economy’s direction, such as Paul Ryan, former Republican Speaker of the House of Representatives, who has become a critic of Trump.

«There is no logic to this other than the president wanting to raise tariffs based on his whims, his opinions,» Ryan told CNBC on Wednesday. «I think there are storm clouds ahead because I think they are going to have some legal problems.»

Only the courts could stop Trump’s tariffs

Trump is aware of the risk that the courts could overturn his tariffs, prompting him to write on his social media platform Truth Social that «THE ONLY THING THAT CAN STOP THE GREATNESS OF THE US WOULD BE A RADICAL LEFT-WING COURT THAT WANTS TO SEE OUR COUNTRY FAIL!»

Even so, the stock market has remained resilient during the recent tariff drama, with the S&P 500 index rising more than 25% from its April low. The stock market rally and the income tax cuts included in Trump’s tax and spending measures signed on July 4 have given the White House confidence that economic growth will accelerate in the coming months.

Global stock markets reacted calmly to Thursday’s tariff adjustments, with Asian stock markets and US futures mostly up.

«Although financial markets seem to have become desensitized to tariff announcements, let’s not forget that their adverse effects on economies will unfold gradually over time,» Brzeski warned.

For now, Trump continues to predict an economic boom while the rest of the world and American voters wait nervously.

«There is one person who can afford to be unconcerned about the uncertainty he is creating, and that is Donald Trump,» said Rachel West, a senior fellow at The Century Foundation who worked on labor policy in Joe Biden’s administration. «The rest of Americans are already paying the price for that uncertainty.»